Picture this: it’s the end of the tax year. You’re staring at a pile of receipts, spreadsheets, and half-remembered expenses. You’re not alone. For many sole traders and landlords, tax season feels like a mix of confusion, dread, and caffeine.

But what if it didn’t have to be that way?

That’s the idea behind Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) — HMRC’s plan to make tax simpler, more accurate, and (dare we say it?) less stressful.

Let’s break it down.

What is Making Tax Digital for Income Tax?

Making Tax Digital for Income Tax is HMRC’s initiative to change the way sole traders and landlords report their income. If your qualifying earnings exceed a certain threshold, you’ll need to:

- Keep digital records of your income and expenses,

- Use MTD-compatible software,

- Submit quarterly updates to HMRC,

- And file a final declaration at the end of the year.

No more last-minute spreadsheets. No more shoeboxes full of receipts.

Who needs to comply (and when)?

Here’s the timeline:

• From April 2026: If your total self-employment and/or property income exceeds £50,000 in tax year 2024-25, MTD for ITSA applies to you.

• From April 2027: If total qualifying earnings in 2025-26 exceeds £30,000.

• From April 2028: If total qualifying earnings in 2026-27 exceeds £20,000

Not sure if you’re affected? Use HMRC’s official tool to check:

👉 Check if you need to use Making Tax Digital for Income Tax here.

Why is HMRC doing this?

Because mistakes are costly. HMRC estimates that £5 billion is lost each year due to errors in Self Assessment. MTD aims to fix that by:

- Reducing human error,

- Saving time on admin,

- Helping you stay on top of your finances throughout the year.

It’s not just about tax. It’s about peace of mind.

How to prepare for MTD for Income Tax?

Here’s your action plan:

- Check your income – Are you over the threshold?

- Choose MTD-compatible software – There are many options, from simple apps to full accounting platforms.

- Start keeping digital records – The earlier you start, the easier it becomes.

- Speak to your accountant – (That’s us!) We can help you get set up and stay compliant.

When are MTD for Income Tax updates due?

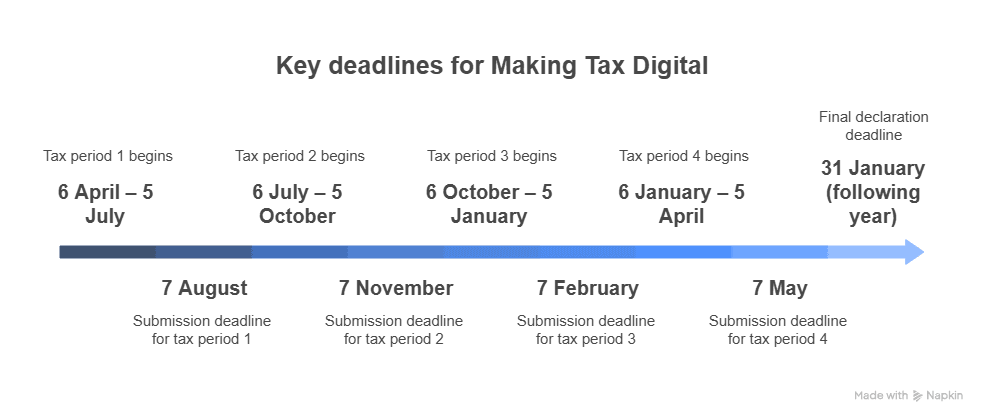

Once you’re signed up for Making Tax Digital for Income Tax, you’ll need to submit quarterly updates to HMRC. These updates summarise your income and expenses for each three-month period — and yes, even if you’ve had no income or expenses, you still need to submit a nil return.

Quarterly update periods and deadlines.

Each tax year will be broken down into four update periods:

Your first quarterly update will be due by 7 August 2026, covering the period from 6 April to 5 July 2026, assuming you fall under the April 2026 start date (i.e. your income is over £50,000).

Your MTD-compatible software will help you track these deadlines and submit your updates on time.

What happens after your fourth update?

So, you’ve submitted all four quarterly updates — what’s next?

You’re nearly at the finish line, but there’s one final step to complete your tax year under Making Tax Digital for Income Tax:

🧾 Submit Your Final Declaration

This is where you:

- Confirm that your income and expenses for the year are complete and accurate,

- Make any final adjustments (like capital allowances or reliefs),

- Add any other income not included in your quarterly updates (e.g. interest, dividends),

- Finalise your tax position for the year.

This final declaration replaces the traditional Self Assessment tax return for those fully within MTD.

📅 Deadline: 31 January

Just like the current system, your final declaration must be submitted by 31 January following the end of the tax year.

For example, for the 2026/27 tax year, the deadline will be 31 January 2028.

💡 Tip: Your MTD software should guide you through this process, but it’s always wise to check in with your accountant to make sure everything is accurate and complete.

When do you pay your tax under MTD for Income Tax?

One of the most common questions we hear is: “If I’m submitting quarterly updates, does that mean I have to pay tax quarterly too?”

The answer is: not necessarily.

Under Making Tax Digital for Income Tax, your payment deadlines remain the same as under the current Self Assessment system — at least for now.

🧾 Current Payment Deadlines:

• 31 January following the end of the tax year – this is when your balancing payment is due, along with your first payment on account (if you need to pay it) for the next tax year.

• 31 July – this is when your second payment on account is due.

So, for the 2026/27 tax year (the first full year under MTD for ITSA for many), your final tax payment will still be due by 31 January 2028, unless HMRC introduces changes in the future.

💡 Important: While you’ll be submitting quarterly updates, these are for reporting purposes only — not for paying tax. However, HMRC may use these updates to give you a more accurate estimate of your tax liability throughout the year.

Who’s off the hook? When MTD for Income Tax doesn’t apply.

Not everyone needs to jump on the Making Tax Digital bandwagon. There are a few situations where you’re either automatically excluded or can apply to opt out.

You won’t need to follow MTD for Income Tax if:

- You fall into a category that’s automatically exempt — for example, due to age, disability, or if you live somewhere without reliable internet access.

- You’ve applied for an exemption and HMRC has given you the green light.

- Your combined income from self-employment and UK property is £20,000 or less per year.

If you’re unsure whether you qualify, it’s worth checking with your accountant or using HMRC’s online tools. And if you think MTD might be more burden than benefit in your case, there’s a formal process to request an exemption. More information you can find following this link.

Can I use spreadsheets for MTD?

Yes — you don’t need to invest in expensive software if you’re already using spreadsheets. HMRC allows the use of spreadsheets as long as they’re linked to MTD-compatible bridging software. This means you can continue using tools like Excel, and the bridging software will handle the digital submission part.

💡 Tip: Ask your accountant which bridging tools are approved and easy to use.

Is MTD for Income Tax the same as MTD for VAT?

Not quite. While both fall under the Making Tax Digital umbrella, MTD for VAT and MTD for Income Tax are separate schemes with different rules, start dates, and software requirements.

• MTD for VAT is already mandatory for most VAT-registered businesses.

• MTD for Income Tax (MTD for ITSA) is being phased in from April 2026 for sole traders and landlords.

The psychology of change: why we procrastinate?

Let’s be honest. Most people don’t delay because they’re lazy — they delay because they’re overwhelmed. New systems, new rules, new software… it’s a lot.

Making Tax Digital for Income Tax isn’t just a government mandate. It’s an opportunity to take control of your finances, reduce stress, and make smarter decisions.

And you don’t have to do it alone.

If you are seeking guidance on how to prepare for Making Tax Digital (MTD) for Income Tax, whether you are landlords or sole traders, we are here to assist you. Please do not hesitate to reach out if you require any support or further information.

Let’s make tax digital. And let’s make it simple.